Achieving Corporate Governance that Drives Corporate Value Enhancement

Governance

Goals and KPIs

2030 Goal

- Goal

- Implement highly effective corporate governance that enables the kubell Group to achieve dramatic growth and long-term corporate value enhancement through exceptional value creation

- KPIs

-

- Ensure the diversity of the Board of Directors (clarify functions to be acquired by the board, disclose skill matrix, etc.)

- Enhance supervisory functions, etc. (at least 50% independent outside directors, increase separation of supervisory and executive functions, establish an internal audit office, evaluate board effectiveness, enhance disclosure of executive remuneration)

- Strengthen supervision of response to sustainability issues and information disclosure (establish a Sustainability Committee, disclose ESG information)

2026

- Goal

- Establish the foundation for highly effective corporate governance that supports Group management

2024

- Goal

- Establish corporate governance that is appropriate to stage of growth based on requirements of the Corporate Governance Code

- Initiatives

-

- Establish a Remuneration Committee and revise the remuneration system for directors

- Appoint full-time Audit and Supervisory Committee members

- Formulate a basic policy regarding the elimination of anti-social forces

Approach and System

Basic Approach to Corporate Governance

We will achieve sustainable growth and long-term corporate value enhancement by continuing to create unique value for society through our mission as well as by meeting the expectations and demands of stakeholders, including shareholders.

Our company was listed on the Tokyo Stock Exchange Mothers Index (at the time) in 2019; however, the environment surrounding our company continues to change. We believe that, in order to achieve sustainable growth in this environment, we must establish highly effective corporate governance. This includes making appropriate and speedy management decisions in response to changes in the business environment, including risk-taking, and managing in a way that is efficient, sound, transparent, and reliable. Going forward, we will work steadily to ensure a corporate governance structure that is appropriate for our stage of growth, taking into consideration the Tokyo Stock Exchange’s Corporate Governance Code.

We submit Corporate Governance Reports to the Tokyo Stock Exchange.

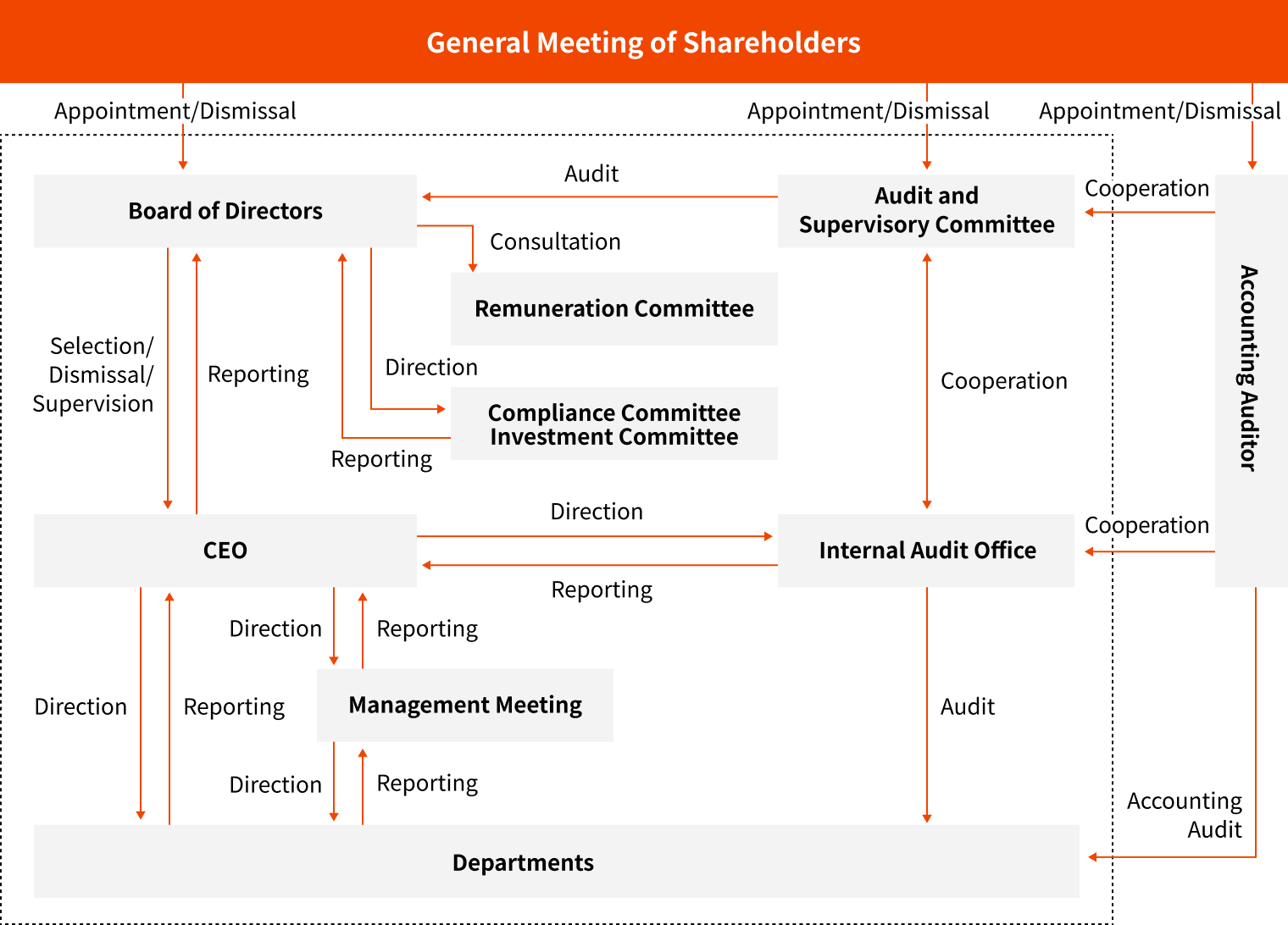

Corporate Governance Structure

We are working to build a corporate governance structure that is appropriate for our stage of growth, based on the belief that establishing a governance structure that can be trusted by shareholders, investors, and other stakeholders is the foundation for sustainable growth and long-term corporate value enhancement. Currently, we are working to strengthen the supervisory functions of the Board of Directors. At the same time, we have chosen to operate as a Company with Audit and Supervisory Committee because we believe that it is effective in improving the fairness, transparency, and efficiency of management by making prompt decisions and executing business through the delegation of authority.

Corporate Governance Structure Chart

Board of Directors

Our Board of Directors takes on the responsibility of achieving our mission and enhancing our long-term corporate value by making important management-related decisions, maximizing returns for each stakeholder, and establishing a highly effective corporate governance structure.

In order to fulfill this responsibility, the Board of Directors consists of eight directors (including five independent outside directors) as of July 2025. With the addition of a female outside director in 2024, we have secured a diverse composition that has a good balance of experience, expertise, and other attributes.

The Board of Directors holds regular monthly meetings in addition to extraordinary meetings as necessary. The board makes resolutions on important matters in accordance with Board of Directors regulations as a management decision-making body. It also supervises the execution of business operations and delegates authority as necessary in accordance with internal regulations to speed up the decision-making process regarding the execution of business operations. Furthermore, outside directors provide advice and oversight to the Board of Directors from an external, third-party perspective. The Board of Directors is chaired by Representative Director, President, Senior Executive Officer & CEO Masaki Yamamoto

Audit and Supervisory Committee

The Audit & Supervisory Committee is composed of four Audit & Supervisory Committee members, all of whom are outside directors, as of July 2025. It holds monthly ordinary meetings and extraordinary meetings as necessary. The Audit & Supervisory Committee members exchange information, deliberate, and make decisions on important matters related to auditing within the Committee. Furthermore, members of the Audit & Supervisory Committee attend Board of Directors meetings as outside directors and state opinions as necessary, thereby enabling them to constantly monitor the execution of duties by the directors. The Audit & Supervisory Committee is chaired by Outside Director (Full-time Audit & Supervisory Committee Member) Akiko Kumakura.

Management Meeting

The Management Meeting is attended by senior executive officers, including three full-time directors (excluding directors who are members of the Audit & Supervisory Committee), and executive officers as needed. It is generally held once a week to deliberate and decide on matters stipulated in internal regulations such as the “Authority and Responsibility Regulations.” The members of the Management Meeting report and share the status of business execution, exchange opinions on common issues, and deliberate and discuss matters. Furthermore, an outside director (full-time Audit & Supervisory Committee member) also participates in the Management Meeting and states her opinion. The Management Meeting is chaired by Representative Director, President, Senior Executive Officer & CEO Masaki Yamamoto.

Remuneration Committee

The Remuneration Committee was established on March 19, 2024, by a resolution of the Board of Directors as an arbitrary advisory body to the Board of Directors, with the objective of enhancing the fairness, transparency, and objectivity of the procedures related to the remuneration of the company’s directors (excluding directors who are Audit & Supervisory Committee members), senior executive officer(excluding the company’s directors), and executive officers, and making executive remuneration contribute to the improvement of corporate value over the medium to long term. As of July 2025, it is composed of seven directors selected by resolution of the Board of Directors, of which a majority are independent outside directors (Audit & Supervisory Committee members), and meetings are held once every six months. The Remuneration Committee is chaired by Outside Director (Full-time Audit & Supervisory Committee Member) Akiko Kumakura.

Compliance Committee

The Compliance Committee, chaired by the officer responsible for compliance (Director, Senior Executive Officer & CFO Naoki Inoue) and composed of members from risk and compliance-related departments, holds regular committee meetings once every quarter. In addition, directors (full-time Audit & Supervisory Committee members) and members of the internal audit department participate in the Compliance Committee as observers and state their opinions. The activities of the Compliance Committee are reported to the Board of Directors and the Audit & Supervisory Committee in a timely manner.

Investment Committee

The Investment Committee is composed of four senior executive officers, including three full-time directors, and specifically discusses and decides on the execution of the Company’s investments, giving instructions to the respective departments in charge. The Investment Committee is also held as needed depending on the case, and outside directors who are not Audit & Supervisory Committee members participate and state their opinions. The Investment Committee is chaired by Director, Senior Executive Officer & CFO Naoki Inoue.

Executive Officer System

We implemented an Executive Officer System to speed up decision-making and enhance our ability to respond to changes in the business environment. This system allows us to execute strategies promptly and reliably by clarifying the authority and responsibilities related to the execution of these strategies and assigning them to executive officers.

Accounting Auditor

We have entered into an auditing contract with Ernst & Young ShinNihon LLC.

Meetings Held

| Meeting Body | Number of Meetings Held in FY2024 |

|---|---|

| Board of Directors | 20 |

| Number of Audit & Supervisory Committee meetings | 17 |

| Number of Remuneration Committee meetings | 2 |

| Number of Investment Committee meetings | 4 |

| Number of Compliance Committee meetings | 2* |

* Number of meetings held after the compliance structure was changed in July 2024

Attendance for Meetings Held

| Meeting Body | Name | 2024 |

|---|---|---|

| Number of Board of Directors meetings attended (attendance rate) | Representative Director & CEO Masaki Yamamoto | 20 (100%) |

| Director & CFO Naoki Inoue | 20 (100%) | |

| Director & COO Shoji Fukuda | 20 (100%) | |

| Outside Director Tomohiro Miyasaka | 20 (100%) | |

| Outside Director (Full-time Audit & Supervisory Committee Member) Akiko Kumakura | 16 (100%)* | |

| Outside Director (Audit & Supervisory Committee Member) Masayuki Murata | 20 (100%) | |

| Outside Director (Audit & Supervisory Committee Member) Akenobu Hayakawa | 20 (100%) | |

| Outside Director (Audit & Supervisory Committee Member) Fumiyuki Fukushima | 20 (100%) |

* Calculated based on attendance of Board of Directors meetings after appointment as director (Audit & Supervisory Committee member) at the General Meeting of Shareholders held in March 2024

Key Areas of Professional Experience of Directors (Skills Matrix)

| Name | Corporate / Business Management |

Finance / Accounting |

Capital Markets / M&A |

Legal / Risk Management |

Global Business | Technology / Trends |

Business Strategy / Marketing |

ESG |

|---|---|---|---|---|---|---|---|---|

| Representative Director & CEO Masaki Yamamoto |

● | ● | ● | ● | ||||

| Director & CFO Naoki Inoue |

● | ● | ● | ● | ||||

| Director & COO Shoji Fukuda |

● | ● | ● | ● | ||||

| Outside Director Tomohiro Miyasaka |

● | ● | ● | ● | ||||

| Outside Director (Full-time Audit & Supervisory Committee Member) Akiko Kumakura |

● | ● | ● | |||||

| Outside Director (Audit & Supervisory Committee Member) Masayuki Murata |

● | ● | ● | ● | ||||

| Outside Director (Audit & Supervisory Committee Member) Akenobu Hayakawa |

● | ● | ● | ● | ||||

| Outside Director (Audit & Supervisory Committee Member) Fumiyuki Fukushima |

● | ● | ● | ● |

Main Initiatives

Internal Controls

We have established a “Basic Policy on Internal Control Systems” in order to ensure sound and efficient management of our corporate activities. We maintain and operate an internal control system based on this policy to manage whether there are any problems in areas such as compliance with laws and regulations, reliability of financial reporting, appropriateness of business execution, and corporate risk management.

Policy on Internal Controls

The Company has established various rules and regulations to ensure the appropriateness of its business operations, developed an internal control system, and is striving for its thorough implementation. In addition to audits by the Audit & Supervisory Committee, the internal audit department conducts internal audits to check the status of compliance with various rules and the effective functioning of the internal control system. The internal audit department also collaborates with the Audit & Supervisory Committee and the accounting auditor to ensure audit effectiveness.

The “Basic Policy on the Internal Control System” is reported under “IV. Matters Concerning the Internal Control System” of the Corporate Governance Report.

Remuneration System

Remuneration for Directors

Remuneration for directors consists of fixed and variable remuneration (short-term performance-linked compensation and medium- to long-term stock compensation). Short-term performance-linked compensation is linked to rate of achievement against the planned annual budget, and medium- to long-term stock compensation is linked to shareholder value. We do not set short-term performance-linked remuneration for directors who are Audit and Supervisory Committee members from the perspective of their role and independence.

Maximum Total Amount of Remuneration for Directors (Fiscal Year 2024)

| Director Remuneration (Excluding Audit and Supervisory Committee members) |

Monetary remuneration | Up to 200 million yen per year (including 50 million yen per year for outside directors) |

|---|---|---|

| Pre-grant restricted stock remuneration (RS) | Up to 120 million yen and 116,000 shares per year (including 20 million yen and 23,200 shares per year for outside directors) | |

| Performance-linked restricted stock remuneration (PSU) | Up to 2,000 million yen and 812,000 shares (for three fiscal years) * Not applicable for outside directors |

|

| Auditor Remuneration (Audit and Supervisory Committee members) |

Monetary remuneration | Up to 50 million yen per year |

| Pre-grant restricted stock remuneration (RS) | Up to 20 million yen and 23,200 shares per year |

Total Amount of Remuneration, etc. for Directors and Auditors (FY2024)

| Role | Total Amount of Remuneration | Total Amount of Remuneration, etc. by Type | Number of Eligible Board Members (People) | ||

|---|---|---|---|---|---|

| Basic Remuneration | Performance-linked Remuneration, etc. (such as non-monetary remuneration) |

Restricted Stock Remuneration | |||

| Directors, excluding Audit & Supervisory Committee members (Outside directors) |

162.914 million yen (6.999 million yen) |

57.453 million yen (3 million yen) |

62.499 million yen (0) |

42.961 million yen (3.999 million yen) |

4 (1) |

| Directors who are Audit & Supervisory Committee members (Outside directors) |

27.249 million yen (27.249 million yen) |

24.249 million yen (24.249 million yen) |

ー | 2.999 million yen (2.999 million yen) |

4 (4) |

| Total (Outside directors) |

190.164 million yen (34.249 million yen) |

81.703 million yen (27.249) |

62.499 million yen (0) |

45.961 million yen (6.999 million yen) |

8 (5) |

* With the performance-linked stock remuneration system introduced through a resolution at the company’s 20th Ordinary General Meeting of Shareholders held on March 27, 2024, the amount of performance-linked remuneration, etc. stated is the amount recorded as provision for the current fiscal year.

Major Board of Directors Discussions (Fiscal Year 2024)

To achieve our Medium-Term Business Plan, the Board of Directors discussed the following topics in light of our business situation, the stock market, and various external conditions such as the social environment.

Major Board of Directors Discussions (Fiscal Year 2024)

- Matters related to Medium-Term Business Plan and enterprise plan

- Matters related to investment policy, including M&A and PMI

- Matters related to new business and subsidiaries

- Matters related to compliance and internal controls

etc.

Initiatives to Strengthen Effectiveness of Governance

To implement highly effective corporate governance that enables us to achieve dramatic growth and long-term corporate value enhancement through exceptional value creation, we are working to establish corporate governance that is appropriate to stage of growth based on requirements of the Corporate Governance Code.

In March 2023, we transitioned from a company with board of company auditors to a company with audit and supervisory committee to strengthen and enhance our corporate governance structure. In addition, the Remuneration Committee was established by a resolution during the meeting of the Board of Directors held in March 2024 as an arbitrary advisory body to the Board of Directors, with the objective of enhancing the fairness, transparency, and objectivity of the procedures related to remuneration and such, and making executive remuneration contribute to the improvement of corporate value over the medium to long term.

We are also strengthening the roles and responsibilities of outside directors in our corporate governance structure, such as the selection of a full-time Audit & Supervisory Committee member in March 2024, to promote sustainable corporate growth and enhance medium- to long-term corporate value as well as strengthen the effectiveness of our corporate governance, including carrying out supervision of the management.

Progress of 2030 Goal

| 2030 KPIs | Progress in FY2024 |

|---|---|

| 1. Ensure the diversity of the Board of Directors (clarify functions to be acquired by the board, disclose skill matrix, etc.) |

|

| 2. Enhance supervisory functions, etc. (at least 50% independent outside directors, increase separation of supervisory and executive functions, establish an internal audit department, evaluate board effectiveness, enhance disclosure of executive remuneration) |

|

| 3. Strengthen supervision of response to sustainability issues and information disclosure (establish a Sustainability Committee, disclose ESG information) |

|

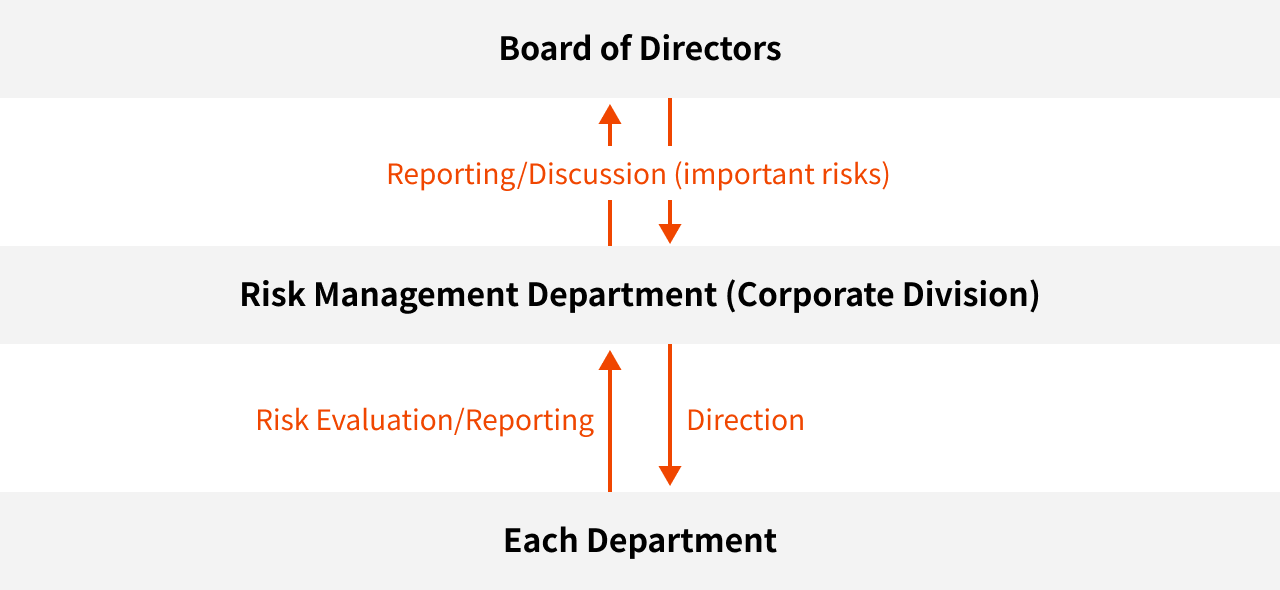

Risk Management

We have established and are implementing risk management regulations in order to comprehensively recognize and evaluate risks associated with the execution of our business operations and to appropriately respond to such risks. If a risk of loss is discovered due to changes in the internal or external management environment, violations of laws and regulations, violations of the Articles of Incorporation, or other reasons, the Risk Management Department plays a central role in discussing matters such as risk-related measures and responses to incidents, and clarifies a system for reporting the progress and results of said response to the management team.

Risk Management System

We regularly conduct risk assessments of all departments once a year for the following risk items, report to the Board of Directors, and hold discussions with the CEO and other executives in charge to confirm specific measures and countermeasures. In addition, discussions are held on a case-by-case basis for important risks (incident occurrences, etc.) that require emergency responses to prevent the risks from escalating and to quickly bring them under control.

Risk Management Items

- Service/system failure risks, business incidences

- Information leakage, false information distribution risks

- Legal/compliance violation, employee misconduct risks

- Abuse/reputation risks

- Safety management/human resource management/asset loss risks

- Business strategy/business management/accounting and finance risks

Risk Management System Chart

Information Security

Information security is positioned as our most important management issue. We established our “Basic Policy on Information Security” and information security structure to ensure information security. Please refer to “Advanced Information Security and Privacy Protection” for details.

Advanced Information Security and Privacy Protection

Value Creation Process to Achieve Our Mission

Social Value Creation through Business

Issues Related to Enhancing Value Creation Infrastructure

Contribution to Solving Global Social Issues

- Sustainability

- Value Creation Process to Achieve Our Mission

- Achieving Corporate Governance that Drives Corporate Value Enhancement